Wakefield fashion firm Bonmarché Holdings has collapsed into administration, putting almost 2,900 jobs at risk.

Tony Wright, Alastair Massey and Phil Pierce, partners at specialist business advisory firm FRP Advisory, have been appointed as joint administrators.

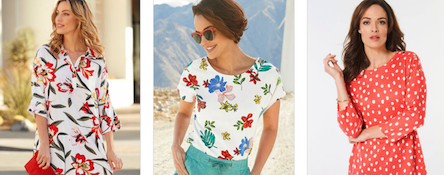

Bonmarché is a fashion retailer targeting the over-50s market.

The business employs 2,887 people, including 200 staff at its head office, and trades through 318 stores across the UK, online and by telephone.

FRP said the directors took the step to place the business into administration “after a sustained period of challenging trading conditions and cashflow pressure, which meant the business was unable to meet its financial obligations as they were due.”

The joint administrators will now continue to trade Bonmarché while assessing options to secure a future for the business.

All stores remain open and no redundancies have been made.

Tony Wright said: “Bonmarché has been a staple on the UK high street for nearly three decades, but the persistent challenges facing retail have taken their toll and led to the administration.

“There is every sign that we can continue trading while we market Bonmarché for sale and believe that there will be interest to take on the business.”

Earlier this year, Edinburgh Woollen Mill Group owner Philip Day became the majority owner of Bonmarché, with a 95% stake via his Dubai-based investment vehicle Spectre.

A spokesperson for Spectre said: “We are disappointed with the result of our investment in Bonmarche, but our primary thought at this time is with the business’ employees and families.”

Bonmarche CEO Helen Connolly said: “It is with deep regret and sadness that we have appointed administrators.

“Over the last 18 months, trading in our stores and market conditions on the high street have significantly worsened.

“This has overwhelmed the business and its financial position.

“The high street is going through a period of historic difficulty and we have been unable to weather the economic headwinds impacting the whole of the retail sector.

“We have spent a number of months examining our business model and looking for alternatives.

“But we have been sadly forced to conclude that under the present terms of business, our model simply does not work.

“We have examined other options, including that of a CVA or refinancing, but do not believe these options will fundamentally change the core challenges facing the business.

“We are sadly no longer in a position to demonstrate to our shareholders that the business can continue as a going concern.

“Our market position has not been helped by the protracted economic uncertainty caused by the drawn-out Brexit process.

“The delay in Brexit has created negativities both in the global markets towards Britain and damaged consumer sentiment and retail footfall on the high street.

“These have compounded the challenges we were facing and without such a delay, it is feasible to believe that our issues would have been more manageable.

“Instead, it has only intensified the pressures.

“In the later stages of our struggle with these issues, Spectre became the majority shareholder of the business.

“We would like to thank Spectre and their team of advisors for their advice, guidance and support over the last few months.

“We believe that if we had had an opportunity to work with the Spectre team closely at an earlier stage, another outcome would have been possible.

“Our first priority is to our colleagues and their families in the face of this difficult news.

“This is not the outcome we had hoped for and we will work with the administrators to do all it possibly can to protect as many jobs as possible and work towards finding a buyer for the business that can secure its future going forward.”