Manchester and Vienna-based biotech firm F2G Ltd on Wednesday announced it has secured $60.8 million in financing from new and existing investors.

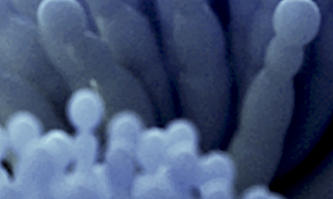

F2G develops novel therapies for life-threatening systemic fungal infections.

The financing round was led by Cowen Healthcare Investments and included participation from existing investors Novo Holdings, Morningside Ventures, Brace Pharma Capital and Advent Life Sciences.

Proceeds from the financing will be used to fund F2G’s late-stage clinical programs for its novel antifungal agent olorofim “and organisational scale-up in preparation for commercialisation.”

F2G said: “Olorofim (formerly F901318) is F2G’s lead candidate and is in a Phase 2b open-label study focussing on rare and resistant life-threatening invasive fungal infections, such as invasive aspergillosis (including azole-resistant strains), scedosporiosis, lomentosporiosis, fusariosis, scopulariopsosis, and coccidioidomycosis (Valley Fever).

“Olorofim was granted Breakthrough Therapy designation (BTD) for the indication of ‘Treatment of invasive mold infections in patients with limited or no treatment options, including aspergillosis refractory or intolerant to currently available therapy, and infections due to Lomentospora prolificans, Scedosporium, and Scopulariopsis species’ in November 2019 by the US Food and Drug Administration (FDA), the only antifungal agent ever to have been awarded this status.

“Olorofim has the potential to be the first truly novel mechanism antifungal therapy for nearly twenty years and represents a very significant market opportunity in an area of high unmet clinical need.”

Ian Nicholson, CEO of F2G Ltd, said: “Following a successful year during which F2G has received FDA Breakthrough Therapy designation for olorofim, as well as FDA Orphan Drug Designation for Coccidioidomycosis (Valley Fever), and QIDP designation in multiple fungal infections, today’s announcement is a significant milestone.

“We are delighted to welcome Cowen Healthcare Investments to F2G, and I would like to thank our existing investors for their continued support.

“This financing marks the continued commitment of our shareholders and paves the way for the advanced development and potential approval of the first new antifungal treatment in 20 years, offering hope for patients with very limited treatment options and a high medical need.”

Cowen Healthcare Investments MD Tim Anderson said: “The necessity for the discovery and development of treatments to tackle infectious diseases is today more apparent than ever.

“F2G’s antifungal candidate demonstrates significant promise in terms of safety, tolerability, and efficacy.

“With our focus on supporting transformational science that can deliver real clinical outcomes, we are pleased to work with this proven management team and group of renowned investors to build on F2G’s significant scientific and commercial potential.”

Anderson will join the F2G Board in conjunction with the financing along with Will West, Investment Advisor at Morningside Ventures, and Naveed Siddiqi, Partner at Novo Ventures.

Siddiqi takes over from Martin Edward,s who is retiring from the board.

Nicholson added: “We welcome Tim Anderson, Will West and Naveed Siddiqi who replaces Martin Edwards as the representative of Novo Holdings on the board of directors.

“On behalf of the Board we would like to thank Martin for his contribution to F2G.

“His industry expertise and counsel have been instrumental in guiding F2G through recent developmental and financing milestones, and we wish him the very best.”