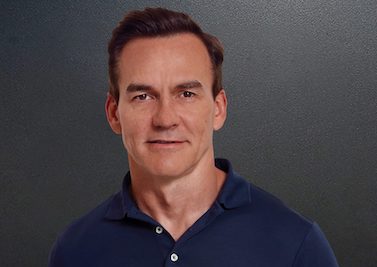

Matthew Moulding, founder and CEO of Manchester e-commerce, beauty and nutrition giant THG plc, told GQ magazine in an interview he should have listed the company in the United States and not in London, and that the experience “has just sucked from start to finish.”

In the interview, Moulding also compared short-sellers to bank robbers.

THG went public at £5 a share in September 2020 and the stock rose to almost £8. However, it has now fallen to around £2.06 amid concerns about transparency and governance from some investors.

“I should have IPO’d in America,” said Moulding.

“That’s obvious. I didn’t do it because I wanted to do everything in Britain.

“We create thousands and thousands of jobs.

“For those of you that have ever been to Manchester, we’re constantly building big buildings up there and infrastructure and I wanted to do everything here really – out of 14,000 staff we’ve probably got 12 (thousand) in the UK.

“And I didn’t want to do the US route.

“Now, there’s a reason I should have gone, and actually I’d have had no profile as well, which would have suited me.

“No one would have written on me if I’d have been listed in the US.

“But it just is what it is.

“Next year it will be a different lesson.”

Asked about “the plan from here” Moulding said: “I’d be lying if I said the share price doesn’t bother me, because it’s like having your homework marked every single day …

“Equally, it doesn’t have to … we do have other options in terms of I’m a big shareholder – more than half of the business is owned by me and a few people that I’m close with.

“So, you know, the share price only moves because of the balance of shares that might trade around.

“So I’ll just … open mind.”

Asked why he changed his mind about staying private by going public with the London IPO, Moulding said: ““I thought the pandemic, when it came, was going to be a big, big impact on business.

“And a lot of businesses were struggling with their balance sheets and so I thought, actually, if I get incredibly well-capitalised – and pre-IPO I was carrying half a billion of debt, so I was running things pretty tight myself – and I thought if I get a lot of capital, I can go and take advantage of what would be quite a challenged world and make those investments and really double down.

“I felt that tech and e-commerce would be big winners.

“And so I wanted to access the capital.

“Doing that in a private arena is tough.

“Raising 100 million in a private arena, it can take you six months.

“You can raise a billion in the public markets in 24 hours.

“So that’s just speed.”

Asked about floating THG in London with himself as the company’s chairman, chief executive, biggest shareholder and landlord — and the corporate governance-type questions that raised — Moulding said: “Naivety, a big part of it.

“But let’s be clear, right? LVMH, just the same – from top to bottom, a fantastic business.

“And that’s actually when you go across most (of) the beauty industry, across the tech industry, this is incredibly commonplace where we are.

“Even if you look at the City (of London), all of your pension money, all of the fund managers in the world, the big major money managers, they’ve got the same setup.

“So the difference is: the UK stock market, it’s not common.

“Now, we don’t do things the way everyone else does it and nor will I ever – I just refuse.

“I know that’s the right thing for THG.

“I know it’s the right way to do it.

“So that’s why I did it.

“But the UK stock market is slightly different.”

Asked to explain the past few weeks, Moulding said: “I don’t think it’s just the last few weeks.

“Since I announced the IPO it’s been in the press a lot, which I’ve struggled with.

“I don’t like it. I don’t want it. I don’t seek it.

“Pre-IPO it just blew up. The last few weeks have been even more interesting, I guess: we’ve had a pretty aggressive short attack.

“You wouldn’t rob banks any more – you’d just do short attacks, you can get away with it, it’s legal.

“And essentially, it cuts across a few industries from media, investment banks, fund managers, hedge funds, etc.

“They come together.

“They’re not technically or legally together, but essentially operate in tandem.

“And then they move aggressively to change the share price of a company.

“They bet on the share price falling, ahead of doing some activities.

“They do their activities and then they make a lot of money when the share price falls.”

Asked whether with only 1.2% of THG shares on loan to short-sellers, if it really was that much of an attack, Moulding said: “What happens on an attack is, it’s the undisclosed shorts.

“So what you do is you don’t let anyone know who you are.

“So you operate from the Bahamas or from Switzerland or from these territories, and you short 0.49 per cent, and maybe four or five or six of you as friends, obviously not legally working together, but magically you do operate together, you come on the undisclosed amounts.

“And that’s how you do it.”

Asked how stressful it has been out of 10, Moulding said: “Maximum. Genuinely I can say, from the moment I even announced on my Insta the IPO, from that day forward has been the worst period ever.

“Ever.

“And there hasn’t been a positive day since IPO, or even announcing the IPO, in terms of for what we do.

“Even when you raise a billion, two billion, and you invest the money, because it’s just not been a warm place to be, versus when you’re a private company, you’re operating in a different arena.

“The stress levels have been incredibly high, but not just with the short attack.

“That just adds to it, makes it all the more unpleasant.

“Billions of pounds get wiped off.

“But I’ve not bought any shares. I’ve not sold any shares. To me, it doesn’t really matter.

“The business is amazing. It’s in better shape than it’s ever been.

“We’ve beaten all the numbers we’ve ever said we’re going to do.

“So that bit’s OK. It’s actually just operating in this environment sucks.”

Asked if he could do it all again, would he IPO, Moulding said: “Shit, no. No. I wouldn’t.

“There are very few companies where an individual sets a company up.

“I’ve done it the right way. I’ve done nothing wrong.

“I’ve created 14,000 jobs, given a billion pounds to staff, who’ve sold most of their shares, done loads of things – everything in Britain, tried to support Britain – and, you know, it’s just sucked from start to finish.

“There are scenarios where if you’re not an individual leading a big company, then I think the UK market can work really well.

“But there aren’t any examples, I don’t believe, where an individual brings a big company to a public market and it can go well, certainly as you get to a certain scale anyway.

“Normally you employ a CEO and a chairman and they do it and the profile’s not there.”

Asked why THG’s intention to spin off its beauty division and possibly its nutrition unit as well had “spooked” investors, Moulding replied: “It didn’t spook investors.

“What you’ve got to remember is whatever gets written almost never – and apologies to all the journalists – but it’s not really correct.

“The reality is that we’ve got four really strong divisions, each of which are global leaders.

“And if you want to take them on, and you want to become truly, truly big businesses – even those are going to be too big for the UK market.

“The UK market does not support multifaceted business models.

“So if we were just a beauty business, it’d be great – nutrition, tech or personalisation.

“The US does, right?

“So Amazon would not operate in the UK with that kind of business model.

“So we’re reaching for a solution to be able to take those businesses into, whilst keeping them in the UK, because we’ve done everything in the UK.

“And that is the solution for those, but whether I do that or not, we’ll see how the next few weeks go.”