Manchester e-commerce, beauty and nutrition giant THG plc said on Tuesday its 2021 revenue rose 37.9% to £2.2 billion.

However, the company’s shares fell as much as 10% as THG said that adjusted EBITDA margin for 2021 is expected to be in the range of 7.4% to 7.7%, compared to market expectations of 7.9% and that the early part of 2022 is expected to be “more challenging.”

In a fourth quarter trading statement for the period ended December 31, 2021, THG said Q4 revenue rose 29.7% to £711.7 million.

THG went public at £5 a share in September 2020 and the stock rose to around £8.

However, it has now fallen to around £1.70 following a disastrous presentation to investors last October and concerns over its transparency and governance.

““Under normal circumstances, a business delivering the level of growth seen in THG’s latest update would be applauded by the market,” wrote AJ Bell investment director Russ Mould.

“Sadly, THG has shot itself in the foot thanks to the way it has behaved as a listed company since joining the stock market.

“And that means only something spectacular will lift the share price.

“Failure to deliver the level of detail about the business desired by investors, questionable corporate governance standards, and comments by chief executive Matt Moulding that he wished he’d never floated THG all amount to bad practice as far as investors are concerned, and they’ve voted with their feet which has left the share price languishing well below its IPO price.

“The fact THG is guiding for revenue growth to slow in 2022 is even more reason for disgruntled investors to keep shaking their heads in disbelief.

“Online companies that pitch their story as rapid growth need to live up to the hype.

“So far THG is coming across as an ill-trained runner which has brought sprint tactics to a marathon and found it can’t sustain momentum at top pace.”

In its outlook and guidance, THG said: “Momentum coming into 2022 remains strong across the group following an acceleration in organic revenue growth in Q4 vs. Q3 2021 and with a substantial pipeline of site launches within THG Ingenuity.

“While the early part of 2022 is expected to be a more challenging comparable period due to global lockdowns in H1 2021, and record commodity prices within our Nutrition division, the board expects FY 2022 revenue growth of +22.0% to +25.0% (CCY).

“FY 2021 adjusted EBITDA margin is expected to be in the range of 7.4% to 7.7%, compared to market expectations of c.7.9%, after taking into account c.90bps of adverse foreign currency movements.

“For FY 2022, the group expects adjusted EBITDA margins to improve throughout the year as we see the benefits of 2021 investments in automation offsetting inflationary pressures, in addition to the increasing mix of revenues generated from Ingenuity Commerce.

“The phasing is expected to be weighted to the second half of the year, given movements in raw material prices, transport costs and currencies.”

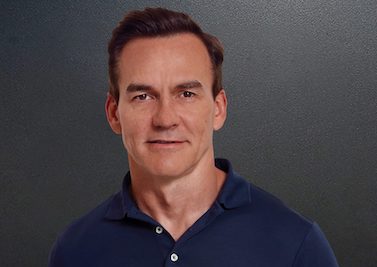

THG CEO Matthew Moulding said: “We are delighted to report significant growth across all divisions during the peak Q4 trading period and to have delivered record annual sales of £2.2billion.

“The operational resilience and performance of our Ingenuity infrastructure was a highlight, dispatching over one million units per day at peak periods.

“The investment we have made in automation in the UK delivered year-on-year efficiencies, and we are on track to launch our first AutoStore facility in the US during Q2 2022, supplementing the six warehouses added to the network across three continents during 2021.

“2021 marked our first full year as a public company and I would like to express my gratitude to all THG colleagues for their dedication and hard work in helping us achieve such a strong performance for the year.

“Despite challenging conditions, we have scaled revenue and expanded our business model, particularly THG Ingenuity, well ahead of expectations given at our IPO 16 months ago.

“At the same time, we welcomed c.3,000 new employees across the world to the group, the majority of whom are within the U.K., and completed many transformational projects, including the opening of our 1m sq. ft. U.K. technology campus, ICON.

“During the year, the group also invested around one billion pounds across infrastructure, technology and M&A to further develop the long-term growth prospects of our key trading divisions.

“We remain committed to our strategy of investing for growth across our global fulfilment network and technology platform.

“The new year has started well, and we remain confident in delivering our strategic growth plans during 2022 and beyond.”