Sheffield-based specialist engineering group Pressure Technologies announced it is likely the company’s ordinary shares will be suspended from trading on AIM on April 3, 2023.

Pressure Technologies said auditors Grant Thornton has advised the firm they will require additional time to complete the FY22 audit and, as a result, “the group is unlikely to publish its FY22 Annual Report ahead of the Annual General Meeting (AGM) which is scheduled for 31 March 2023.

“In the event that the FY22 Annual Report is not published by 31 March 2023, the company’s ordinary shares will be suspended from trading on AIM in accordance with AIM Rule 19 with effect from 7.30 a.m. on 3 April 2023, being the first business day after 31 March 2023,” said Pressure Technologies.

“Suspension from trading will be lifted with the publication of the Annual Report, which will be as soon as possible and currently expected to be no later than the end of April 2023.”

The news was contained in an update from the firm on the audit and the publication of its Annual Report & Accounts for the financial year ended October 1, 2022, forthcoming AGM resolutions, and its current trading.

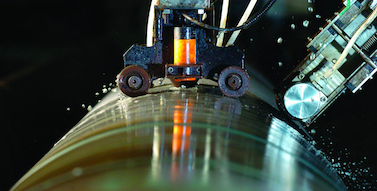

“As part of the ongoing audit process in respect of the financial year ended 1 October 2022, the board is now reviewing its accounting policy and past accounting treatment in respect of a small number of long-term defence contracts within its Chesterfield Special Cylinders division (CSC),” said Pressure Technologies.

“Since FY19, the Group has consistently applied an accounting treatment whereby revenue for these specific defence contracts was recognised using an ‘Output’ methodology under IFRS 15, ‘Revenue from Contracts with Customers’ (IFRS 15), with costs being accrued to achieve a uniform profit margin throughout the multi-year life of the contracts, resulting in cost deferrals at financial period ends.

“Whilst this cost treatment impacted the timing of profit recognition between financial periods, it had no impact on either the total profitability of the contracts over their entire lives, nor the quantum or timing of cash flows.

“The company’s auditor, Grant Thornton UK LLP, has advised the company that this accounting treatment is not in compliance with IFRS 15, which requires that all costs incurred in the period relating to the contract should be immediately expensed.

“This means that cost deferral to achieve a uniform contract profit margin, as historically adopted by the group, is not permitted.

“Subject to final audit confirmation, as a result of a correct application of IFRS 15, the group’s results for FY22 are now expected to reflect a £1.2 million increase in operating losses over the £1.4 million adjusted operating loss1 as notified in the trading update on 15 November 2022.

“The correct application of IFRS 15 has also been applied to prior periods FY19, FY20 and FY21.

“A restatement of the comparative period FY21 in the FY22 results will also be required, by which the previously reported operating loss of £0.7 million will increase by £0.8 million. Adjustments made to operating profit or loss in FY19 and FY20 are individually not material, but do result in a reduction to FY21 opening reserves of £0.3 million.

“However, as a consequence, there will be a corresponding increase in operating profits of £2.3 million over the remaining lives of these contracts, the majority of which is expected to be in FY23 and FY24.

“It is emphasised that these accounting adjustments only impact the timing of profit recognition under these specific contracts. They do not impact the expected net debt position of the group as at 1 October 2022, the future cash generation profile of the group, nor the underlying trading or operations of the business.

“The board’s expectations for overall group revenue of approximately £25 million in FY22 remains unchanged and as set out in the trading update on 15 November 2022.”

In its trading update, Pressure Technologies said: “The board remains confident in underlying market opportunities and continues to foresee a return to profitability and positive cash generation in FY23.

“The positive outlook for the group in the medium and longer term is underpinned by a strong defence order book and pipeline, as most recently evidenced by the £18.2 million contract to supply air pressure vessels for a major UK naval new construction programme, announced on 6 February 2023.

“Also as noted above, compared to previous expectations, the results for FY23 and FY24 will benefit from a majority of the £2.3 million accounting treatment correction in respect of the long-term defence contracts within CSC.

“In addition, the current order book for the Precision Machined Components division is £4.3 million, its highest level since May 2020, with order intake from established international OEM customers expected to reach at least £2 million for the month of March 2023.”