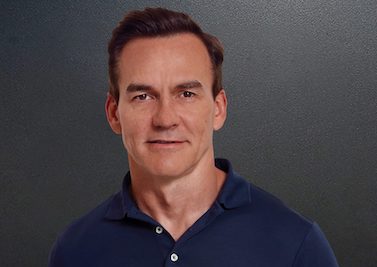

Matthew Moulding, founder and CEO of Manchester-based consumer brands giant THG plc, has blasted the London Stock Exchange (LSE) and the UK’s Financial Conduct Authority (FCA) in a social media posting.

THG has experienced a torrid time since it joined the stock market in London via its IPO.

THG went public at £5 a share in September 2020 and the stock rose to around £8. However, THG shares have since fallen almost 90% to around 95p — slashing the firm’s stock market value to roughly £1.2 billion — following a disastrous presentation to investors and concerns over the company’s structure, transparency and governance

Moulding said plans announced this week by the FCA to reform and streamline UK stock market listing rules “will do little” for the LSE.

And he claimed that “many doubt real change can happen while the FCA continues to be closely supported by an advisory panel made up of the very people it is policing in the City.”

The FCA said this week it is proposing to “reform and streamline” UK stock market listing rules as it ramps up efforts to lure more company listings to the London Stock Exchange.

The FCA said the listing regime in the UK has been seen by some issuers and advisers as too complicated and onerous.

Company stock market listings in the UK have fallen 40% since 2008, according to The UK Listing Review.

The FCA said it is planning “significant changes to the listing rulebook” including replacing its existing “standard” and “premium” listing segments with a single category for equity shares in commercial companies.

In his social media post, Moulding wrote: “It’s been a busy week in the City …..

“First, the City is reforming itself to attract more Founders and Boards to list their companies in London, instead of overseas. I was asked to contribute to the study undertaken by Lord Hill and welcome the changes.

“That said, these changes alone will do little for the LSE. Every company listing in London needs full approval on all aspects of the business, including Governance and Related Parties.

“From THG’s own bitter experience, even though you receive these approvals, anyone not adopting the 1930s-style LSE practices of old is fed to the meat grinder.

“Hedge Funds, with the help of friendly Pundits and Analysts, argue any deviations as bad practice, wrongdoing, or an evil force.

“It’s laughable. Where were all the Hedge Funds, Analysts and Pundits ahead of Tesco’s £250m accounting scandal a few years ago? Or when BT recently had a similar issue in its Italian subsidiary? How did these LSE governance structures prevent the 2008 banking scandals, PPI or Libor rigging? And WANdisco a few weeks ago – really?

“There are barely 200 companies on the LSE with at least £1bn market cap, and none of the ‘highly skilled’ City professionals noticed the alleged massive fraud in WANdisco, as one of London’s 200 most valuable. It’s not like it’s a complex business – after a decade on the LSE it had c£10m in revenues, and then suddenly announced revenues didn’t exist after all.

“And so, the idea that the standards on the LSE are above other markets is ridiculous. Amazon, Meta, Apple, Google – have they really had more scandals than our old economy companies that dominate the LSE? Not even close, and yet each one is many times bigger than the whole of the LSE combined!

“But hope is not lost. Yesterday the FCA announced it’s reforming itself and pledged to do better in tackling bad actors in the City. There were well over 2,000 allegations of foul play lodged with the FCA last year, with the FCA’s own survey finding the vast majority ‘extremely dissatisfied’ with a lack of action or engagement from the FCA. Instead, whistleblowers now often turn to the US regulator as a means of bringing an action in London.

“Many doubt real change can happen while the FCA continues to be closely supported by an advisory panel made up of the very people it is policing in the City. Turkeys don’t vote for Christmas.

“And so maybe the key lesson we should take from the US isn’t more rule changes, but giving our regulator the resources to tackle the well-known bad actors using the LSE as their private piggy bank. Doubling both staff pay and the team at the FCA would be the best investment we could make in London.

“A regulator that protects Founders, Boards and Investors alike, instead of shielding Investment Bankers, Hedge Funds and Pundits, is what it takes to make the LSE attractive once again.

“Hey, but what do I know – other than being a customer of the LSE and the target market for city reforms.”