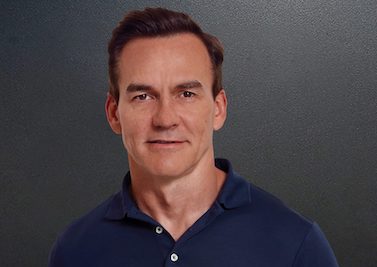

Matt Moulding’s Manchester-based online retailing giant THG plc has agreed to buy London-based business newspaper City AM.

Moulding has had a fractious relationship with London’s financial media since THG joined the stock market in 2020.

City AM co-founder Lawson Muncaster said the deal represented a “perfect fit” for the business.

The business has been purchased in a pre-pack deal from appointed administrators BDO.

THG already publishes digital magazines — The Supplement and The Highlight — with a combined circulation of 600,000.

The Manchester-headquartered firm said it will invest in both editorial and technological resources as well as expanding the paper’s lifestyle and sports categories.

“We’ve long been reviewing opportunities in the disruptive media space but have waited for the right time and the right opportunity to make a digital step-change in adtech capabilities for Ingenuity,” said Moulding.

City AM claims around two million monthly unique visitors online and a daily print circulation of almost 70,000 Monday to Thursdays.

“City AM is one of London’s leading media platforms and we will ensure this remains the case with full editorial independence,” said Moulding.

“This deal helps us reach a huge new audience, complements our successful content creation studios and digital media expertise.”

The acquisition will see City AM’s 40 editorial and commercial staff join the THG Group.

City AM co-founder and longtime CEO Jens Torpe will retire from the business at the conclusion of the deal.

Muncaster, who founded the business with Torpe in 2005, said his partner had “worked tirelessly over the years to ensure that the good ship City AM sailed on through not just a financial crisis but a pandemic, too …”

Torpe said: “During our 18 years we’ve faced a few storms but none as turbulent as the past three years.

“We managed to survive lockdown but unfortunately we didn’t have the money to invest in digital and build on the strong progress we saw during the pandemic.

“I’m therefore delighted that a business like THG has taken over City AM. Their digital expertise will be a great asset, so after 18 years I take comfort in the knowledge that our ‘little baby’ will grow and become more than a teenager.”

THG went public at £5 a share in September 2020 and the stock rose to around £8. However, THG shares have since fallen almost 90% to around 99p — slashing the firm’s stock market value to roughly £1.3 billion — following a disastrous presentation to investors and concerns over the company’s structure, transparency and governance.