Liverpool-based Surface Transforms, makers of carbon fibre reinforced ceramic automotive brake discs, announced it has signed a £13.2 million loan agreement with the Liverpool City Region Urban Development Fund which is part funded by the European Regional Development Fund (ERDF).

“The loan will contribute to the company’s forthcoming £44m investment programme,” said Surface Transforms.

“The investment is supporting capital expenditure that will see the production capacity available in the Knowsley site rise from £50m sales capacity per year in 2024 to £150m sales capacity per year in 2027.

“The capacity increase is required to support the forecast substantial sales increase underpinned by the company’s current £390m lifetime contract value and £300m prospective contract pipeline.

“The remainder of the £44m capital investment programme will be funded from free cash flow as the company moves into profit, still expected during 2024.

“The terms of the loan remain unchanged from those outlined during the fundraising. The loan facility is available for drawdown over an initial two-year period and will be progressively deployed exclusively for capital expenditure purposes.

“Quarterly capital repayments will commence in the first quarter following the completion of the availability period.

“Completion of this loan agreement was a condition precedent to the second phase of the recent equity placing.

“This condition has now been satisfied. The passing of the necessary resolutions is expected at the forthcoming General Meeting on Monday 18 December 2023.”

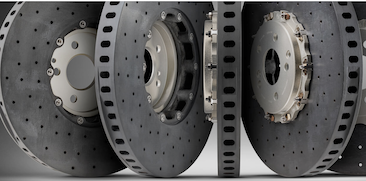

Surface Transforms CEO Kevin Johnson said: “We are delighted to have secured this capital expenditure loan, that will enable us to execute our strategic growth plans and further strengthen our position as a leader in carbon fibre reinforced ceramic automotive brake discs.

“We want to thank our partners in the Liverpool City Region Combined Authority and Knowsley District Council for their support in securing this loan.

“We are now looking forward to concluding the recent equity placing and Open Offer and accelerating our programme of increased capacity installation paving the way for a swift acceleration of our expansion plans.”

Surface Transforms also said its open offer of shares was significantly over-subscribed, raising gross proceeds of £2.7 million.

“Applications were received for 27,420,745 Open Offer Shares, representing a take-up of 137.1 per cent of the 20,000,000 available Open Offer Shares,” said the firm.

“As permitted under the terms of the Open Offer, the board has decided to accept these validly received applications for 27,420,745 Open Offer Shares in full.

“Application will be made for 27,420,745 Open Offer Shares to be admitted to trading on AIM, conditional on the Resolutions being passed. It is expected that admission and dealings in the Open Offer Shares will commence at 8.00 a.m. on 19 December 2023.

“Subject to the Resolutions being passed, £11.0m gross proceeds will have been raised pursuant to the Placing, Subscription and Open Offer.”

Surface Transforms non-executive chairman David Bundred said: “We want to thank investors, for their support of this Open Offer and are delighted, in a difficult market, to have been oversubscribed on both the Placing and Open Offer.

“Together with the £13.2m loan, described during the fund raising and still expected to conclude imminently, the combined £24.2m cash availability gives us the balance sheet strength to accelerate our capacity expansion, thereby delivering the contract wins of recent years.

“We continue to expect to move into profitability and free cash generation in 2024.”