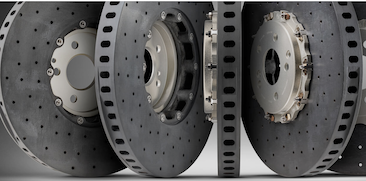

Shares of Liverpool-based Surface Transforms, makers of carbon fibre reinforced ceramic automotive brake discs, fell about 35% to 6p after the firm updated investors on its “capacity constraints” and “continuing high levels of scrap.”

The company’s shares are down about 80% for the past 12 months, reducing its stock market value to around £21 million.

In a stock exchange statement, the firm said: “Surface Transforms (AIM:SCE) manufacturer of carbon fibre reinforced ceramic disc brake materials provides the following sales update for the three months to 31 March 2024 and reconfirms unchanged sales guidance of £23m for the 2024 financial year.

“Sales in the first quarter were £3.0m. The sales trend for the last five quarters have therefore been 2023 Q1 £1.4m, Q2 £1.9m, Q3 £2.0m and Q4 £3.0m followed by Q1 £3.0m in 2024.

“Accepting that £3m maintains our run rate rather than increases it in Q1 2024 and was lower than our internal target, sales in March 2024 were £1.5m.

“Furthermore, significant improvements in the underlying operational performance led by Stephen Easton, Chief Operations Officer, have also been achieved.

“The single point of failure capacity constraints have now, almost all, been resolved, the revised maintenance procedures and continuing operator training have significantly improved plant availability, and performance.

“The prime remaining operational challenge relates to continuing high levels of scrap from processes that are not yet fully capable. Again we regard these issues as a learning curve and note, that considerable success has been achieved in recent weeks in reducing scrap.

“We expect to continue these improvements over the coming months unlocking further capacity.

“The company has now agreed revised 2024 delivery schedules with all customers that progressively pull back arrears. We are broadly keeping to these schedules and the customer situation is stable.

“Progress on installing new capacity …

“The programme is proceeding to plan. We expect all but one of the furnaces for our £50m sales p.a to be on site by mid-year.

“The issue with the last furnace relates to our site expansion rather than the machine itself. The protracted negotiations regarding the site expansion have now been concluded enabling the last furnace to progress.

“Our customers have taken great comfort that the financing for our capital expenditure programmes in 2024 and 2025 has been secured and ring fenced by the terms of our local authority loan.

“Capacity increases can also be achieved by internal work on already installed furnaces which over time can be substantial.

“The company has a number of these projects underway; they are progressing well and form part of 2024 capacity contingency plans.

“Forthcoming results announcement and further updates …

“Our 2023 audit is ongoing, and we expect to announce our preliminary results in late May, at which point a further update on trading will be provided.

“Outlook …

“We are maintaining sales guidance of £23m for the year ending 31 December 2024. However the scrap problems in particular have absorbed a sizeable amount of working capital and cash. The board are assessing options to address this short term issue.

“Board changes

“David Bundred, chairman has confirmed that after 12 years on the board, he intends to retire from this role in 2024. A search process has now started led by Julia Woodhouse who has taken over chair of the Remuneration and Nominations Committee. Further updates will be provided in due course.”

Surface Transforms CEO Kevin Johnson said: “Our priority in Q1 was a combination of fixing the underlying fundamentals and continuing to improve customer relationships. Our customers have been kept fully informed of progress and remain committed.

“The team has also made significant progress on the key challenges of building capacity and reducing scrap which is critical to continuing our ramp up and driving revenue growth during 2024 and 2025. Our commitment to building up production capacity, this year and beyond remains absolute.”