Shares of Elland-based industrial engineering company The 600 Group plc fell 21% on Friday after it issued a trading update on its current year warning that “outturn for the full year is now expected to be significantly below the board’s previously revised expectations.”

The 600 Group said: “In December the Group reported that it had been experiencing certain macro-economic and political uncertainties across its end markets, particularly in the Far East and automotive markets, with order intake for the fourth quarter expected to be significantly below originally predicted levels.

“Trading conditions have since become more challenging with the combination of the General Motors strike in USA plants at the end of last year and the suspension of manufacture by Boeing of its 737 MAX in January this year further impacting hundreds of thousands of suppliers across our core industrial markets.

“Order intake in both Machine Tools and Industrial Laser Systems therefore remains volatile, including two significant projects that have been pushed into the next financial year.

“In addition, the Coronavirus is causing disruption to shipping from the Far East.

“Whilst the Group has no significant volume of sales and little direct sourcing from Mainland China, the effect of delays to deliveries is pushing sales past the end of the March financial year.

“Across UK operations, there continues to be good progress with orders up over 100% on the prior year.

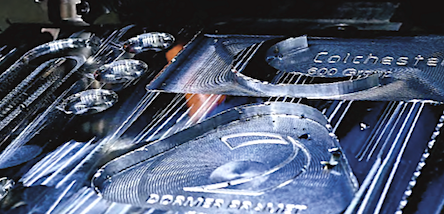

“The group is also pleased to report that contracts have been exchanged for the sale of the Gamet Colchester site for $0.5m.

“This sale is part of the group’s rationalisation of the UK operations of its Machine Tools division to reduce operational risk and capital expenditure requirements.

“Completion is expected in the next few days with the proceeds used to reduce bank debt.

“As a result of the market volatility described above and the expected resultant shortfall in revenue against a relatively fixed cost base, the outturn for the full year is now expected to be significantly below the board’s previously revised expectations.

“Despite these major headwinds, the board continues to believe in the long-term fundamentals of the group, which benefits from a significantly enhanced financial position, and remains optimistic for the future as it continues to pursue its strategy of de-risking and diversifying the business.”