A new report from the British Private Equity and Venture Capital Association (BVCA) reveals that private capital inflows into the UK’s regional economies eclipsed inflows into the London economy during the pandemic year of 2020, with more than £5.3 billion of investment outside of the UK capital.

The “Investing with Integrity” report also found that a record number of businesses — more than 860, or 66% — backed by its members in 2020 were outside of London, representing well over half of the £9.5 billion in investment made in the UK.

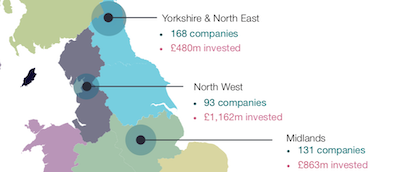

“This included £1.2bn into firms in England’s North West, £863m into the Midlands and £480m into Yorkshire and the North East,” said BVCA.

“Scotland and Northern Ireland also received strong support with £213m and £141m’s worth of investment respectively.

“The report, which uses data gathered from across the BVCA’s membership of private equity and venture capital firms, is the largest primary research survey of its kind in the UK and details how the industry backed UK businesses throughout the Covid-19 pandemic.

“The BVCA’s data goes on to show that more than 5,000 British companies – responsible for over 1 million jobs – are now supported by its members, with 1,300 of these receiving financial backing during 2020 to enable them to grow, invest and come through the pandemic as strong as possible.

“Close to 90% of the 1,300 firms that benefitted from both funding and the hands-on management approach that comes with private equity and venture capital were small or medium sized.”

The BVCA has over 750 member firms including more than 450 fund managers and institutional investors, representing the majority of UK-based private equity and venture capital firms and their advisers.

BVCA director general Michael Moore said: “The scale and breadth of private capital’s investment and support for UK businesses during the pandemic has been significant.

“Whether it’s investing in Vital Energi in Blackburn, Nova Pangaea in Redcar or Bluesona in Downpatrick, private capital is actively helping companies grow and prosper as the economy recovers from the COVID crisis.

“This means new jobs being created, new products coming to market, new ideas being commercialised — all at a time when the UK economy needs it most.”

Technology was the primary focus for investment in 2020.

BVCA members invested £3.4 billion into 557 companies – with 60% of these being start-ups or fledgling businesses yet to experience rapid growth.

While London remains the cornerstone of the UK scene, attracting 55% of total investment, the balance was spread across the UK with particular tech hubs developing in the North West and Yorkshire and the North East – roughly 7% and 14% of UK tech businesses attracting funding were located in these regions.

“Business in the healthcare, life sciences and biotech sectors were also high priority investment targets for BVCA members in 2020,” said the BVCA.

“There’s a clear correlation between private capital support for fledgling businesses ‘spun out’ of universities in these sectors, with 20% of healthcare business investments going to South East England (home of Oxford University) and 14% into the East of England (home to Cambridge University).

“Finally, there’s also comprehensive data on the UK’s attractiveness as a place to raise funds throughout the pandemic, with £44.1bn incoming in 2020 – only a slight dip from the £47.6bn raised in 2019.

“The willingness of investment funds to flow into the country cements the UK’s position as the second largest centre for private equity and venture capital outside of the US and its competitiveness on the global scene.”