Shares of THG, the Manchester-based e-commerce, beauty and nutrition giant, fell another 21% on Tuesday despite the group publishing a third quarter trading statement showing its Q3 revenue rose 38% to £507.8 million and THG continuing its efforts to improve governance amid plans to move its listing to the premium segment of the London Stock Exchange.

THG announced the appointment of Andreas Hansson, a managing director from investor SoftBank, to its board and the start of a process to appoint an independent non-executive chair.

THG also announced growth figures for its Ingenuity technology unit — which it plans to spin off — as it sought to repair its image among investors following a badly-received presentation to investors on Ingenuity earlier this month.

But its shares, which had already fallen 40% this month, fell a further 21% after Tuesday’s announcement.

THG went public at £5 a share in September 2020 and the stock rose to almost £8. However, it has now fallen to £2.42, a new low.

The Manchester-based company has been making efforts to reassure investors since its shares fell 35% in a single session following the investor presentation on Ingenuity.

THG is currently listed on the standard segment of the LSE and the premium listing it now seeks would demand stricter corporate governance standards.

In Tuesday’s announcement, THG said Ingenuity, which sells e-commerce software to other companies, had signed 44 clients in the third quarter ended September 30 and was expecting a “strong pipeline” of new client wins in the current quarter.

THG also gave a positive outlook for Ingenuity, predicting that 2022 revenue from the business will exceed current market expectations by 20-25%.

J.P. Morgan Cazenove analysts wrote in a note: “All in all, some steps clearly in the right direction …

“But we believe the company now has to consistently present new clients (for Ingenuity) on an ongoing base to restore confidence.”

THG owns beauty retailer Lookfantastic and supplements firm Myprotein.

Japanese venture capital giant SoftBank owns about 9% of THG and has an option to buy a 20% stake in Ingenuity.

The badly-received presentation on Ingenuity prompted speculation that SoftBank may not exercise the option — but THG has said it expects the option will be exercised in the first half of next year.

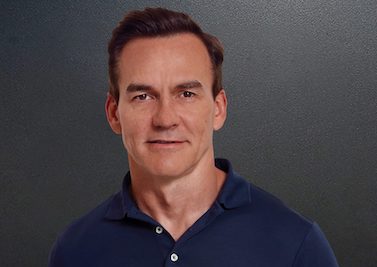

THG founder and CEO Matthew Moulding said: “We have delivered a strong trading performance in Q3 and enter our peak trading period with confidence.

“The recent successful migration of Cult Beauty onto the Ingenuity platform is testament to the resilience of the infrastructure and the expertise of our digital talent.

“In under 10 weeks we have seamlessly migrated Cult Beauty, whilst delivering significant website and customer user-experience improvements at the same time.

“I would like to thank all of our employees given how much they have achieved in the 12 months since IPO.

“Our talented workforce has grown considerably and as well as significantly outperforming the trading guidance provided at IPO, they have been tirelessly expanding the business model across all divisions.

“The appointment of two independent non-executive directors and four special advisors since IPO has been hugely beneficial to the board, and we have real optimism for 2022 with the step-up to a premium listing on the main market of the London Stock Exchange following the appointment of an independent chair.

“Finally, we extend our warmest welcome to Dr. Andreas Hansson from the THG Board and management.

“Our experience with Andreas and the entire SoftBank team has been first-class and this appointment is testament to the strength and depth of the partnership that we have developed.

“The separation of Ingenuity remains on track for H1 2022.”

In its outlook and guidance, THG said: “As reiterated at the group’s interim results, FY 2021 group revenue guidance is growth of between +38% to +41% on a constant currency basis (reported growth of +35% to +38%).

“The group remains on target to trade comfortably ahead of IPO expectations set out in September 2020.

“At IPO the group guided to FY 2021 revenue growth of between +20% to +25%.

“For FY 2021, we expect M&A to contribute c.£260m to revenue.

“Management believes the impact of the recent inflationary environment and rising commodity costs can be largely offset by increased logistics automation and an ongoing cost improvement programme.

“Margin guidance therefore remains unchanged at stable adjusted EBITDA margins on a constant FX basis, before taking into consideration the dilutive full year contribution of Dermstore (which is expected to be in line with group margins by the end of 2022) …

“… revenue for Ingenuity Commerce is expected to be in the range of £108.0m to £112.0m in FY 2022.”

Analysts at Davy stockbrokers wrote: “Q3 revenue growth remained robust with constant currency (cc) growth of 38%, led by its Beauty division (61.1% growth).

“THG reiterated its FY21 revenue guidance.

“FX headwinds will have a greater impact on the EBITDA margin with an estimated 100bps headwind in FY21; as such, our current margin forecast of 8.9% is too high.

“On the conference call, management reiterated its positive view on FY22 revenue growth with Beauty and Nutrition expected to grow in aggregate by 20-25% and a strong outlook on its Ingenuity Commerce platform.

“Today’s weakness in the equity partly reflects downward pressure on FY21 EBITDA consensus estimates relating to margin headwinds.”