Shares of Liverpool-based high performance car brake disk manufacturer Surface Transforms plc soared as much as 10% on Wednesday after it published a trading update for the six months to June 30, 2022.

The manufacturer of carbon fibre reinforced ceramic materials said revenue in H1 of 2022 grew 240% to £2.9 million “reflecting deliveries on the Aston Martin Valkyrie project as well as catch up on the OEM arrears reported at the end of 2021.”

On March 24 this year shares of Surface Transforms plc soared as much as 35% after it announced it signed a new £100 million contract with an unnamed existing customer it called “OEM 8.”

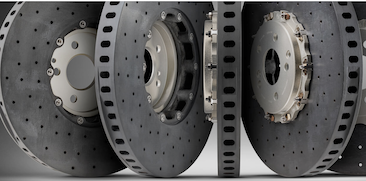

Surface Transforms is the UK’s only manufacturer of automotive carbon‐ceramic brake discs, and one of only two mainstream carbon ceramic brake disc companies in the world.

The company supplies makers of high performance cars. Its customers have included Aston Martin, Porsche, Ferrari and Nissan.

On Wednesday, Surface Transforms said: “On 24 March 2022, the company announced a new £100m (lifetime value) contract with OEM 8 replacing its previous contract for £27m reflecting both increased customer demand for its cars and an extension of contract life.

“Since that announcement, OEM 8 has been in discussions with all participants in its supply chain to match their demand with the detail of suppliers’ capacity constraints.

“Although these discussions caused a small delay to Start of Production (SOP) we are pleased to report that deliveries will commence in July and production schedules and run rates will now continue in line with management expectations …

“The company’s prospective contract pipeline has led to a series of new contract announcements bringing its lifetime contract value to over £180m.

“Furthermore, the company continues to work with new and existing OEM customers and anticipates further contract awards in the second half of the year.”

In its outlook, the company said: “The commencement of OEM 8 full monthly volumes will bring Surface Transforms into profitability for the financial year ending 31 December 2022.

“The small delay in OEM 8 SOP is offset by higher than forecast development revenues with other customers and the board is therefore pleased to restate the guidance provided in the chairman’s report in the 2021 preliminary results; ‘The company continues its journey to profitability in 2022 and remains confident that this goal will be achieved, whilst maintaining our commitment to environmental and social goals’.”