Surface Transforms plc said on Thursday that while a new contract with a US automotive company it called OEM 10 is a considerable strategic win, production challenges throughout the year had been “frustrating”.

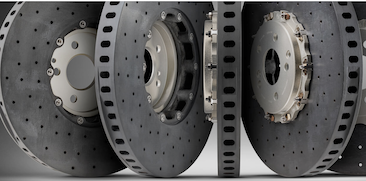

Surface Transforms is a Liverpool-based manufacturer of next-generation carbon-ceramic brake discs for automotive and aircraft applications.

The firm said the contract has “a lifetime value in excess of £100 million.”

Shares of Surface Transforms rose as much as 10%.

The company’s recent agreement with OEM 10, which establishes Surface Transforms as the sole supplier of carbon ceramic brake discs on two model variants covering front and rear axles, is its second contract with the company.

OEM stands for “original equipment manufacturer.”

The lifetime revenue on the contract is estimated to be in excess of £100 million over six years.

Production is scheduled to begin in 2024, followed by production revenues in the first half of 2025. Sales from this contract award are expected to be around £20 million per annum, tailing off in the later years.

Surface Transforms said the contract, the largest it has been awarded to date, would see its discs replace those historically provided by its main competitor.

It did not specify who its competitor was.

However, addressing its projected performance for the year, the company said it now expected sales to be lower than originally forecast at £6.5 million.

This was attributed to technical issues at its customer, OEM 8, which delayed the production ramp and ended up taking more time to solve than had initially been anticipated.

Surface Transforms argued that while the delays were “disappointing”, the value of the contract remained unchanged at £100 million.

Over the year, the company has also faced its own production challenges. Though these have now been “materially rectified”, and were neither the reason for the ramp-up delay nor the bulk of its sales shortfall, it noted that they limited its ability to build a finished stock buffer.

Surface Transforms now expects profit and cash to be around £3 million less than previously anticipated.

In other news, deliveries of the Phase 2 equipment projected to raise capacity to £50 million have continued. Although there are, once again, some project delays associated with supplier supply chain problems, the company said these are broadly covered by project timing contingencies.

Surface Transforms CEO Kevin Johnson said: “The OEM 10 contract is an extremely significant strategic win, achieved against vigorous technical competition.

“Moreover, it underpins the key message of our recent fund raise on the need to be installing capacity in advance of contract wins, thereby giving confidence to our customers of our ability to supply.

“We greatly enjoy working with OEM 10 and look forward to a developing relationship.

“However, the separate combination of customer [start of production] delays and our own challenges is frustrating.

“The general issue of delays in both SOP and the subsequent production ramp has been previously reported and was the reason for the substantial increase in timing contingencies included in the recent fundraising guidance.”

The company’s guidance for 2023 remains unchanged.

Reporter: Holly Beveridge

Copyright 2022 Alliance News Limited. All Rights Reserved.