Liverpool-based Surface Transforms plc said the production problems it reported in January have now been resolved.

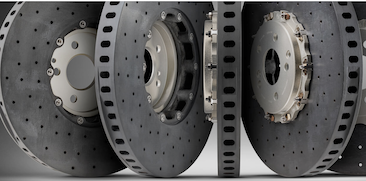

Surface Transforms is a manufacturer of next-generation carbon-ceramic brake discs for automotive and aircraft applications.

In a “production, capacity, and trading update” Surface Transforms said there are more than 20 complex production steps in its overall production process “and all sub-processes are now achieving their individual Q1 2023 daily production targets.”

The firm said that, as previously reported, “one furnace issue in particular, significantly affected output over the past six months, exacerbated by industry-wide supply chain problems for furnace insulation.”

The company made changes to that process in Q1 of 2023, including, but not limited to, use of more readily available materials.

“These changes were successful, and that sub process has now run, at target rates, for over a month,” said the firm.

“This was the last major impediment to meeting ongoing daily customer requirements.”

On its capacity increase, Surface Transforms said: “Over the last 18 months the company has been installing capacity to support contracted sales from £2m p.a. in 2020, to over £30m p.a. in 2024.

“Installation of this capacity increase is on track, with installed revenue capacity of £50m p.a. in place by September 2023.

“This increased capacity will be sufficient to meet Surface Transforms’ growing customer demand for at least the next 18 months.

“This additional capacity also being required to provide resilience, ‘catch-up’, capacity if any further technical problems were to arise.

“The lack of this resilience, preventing the company catching up lost production, has compounded the technical problems over the past six months.”

In a Q1 trading update, the firm said: “The production issues that negatively affected turnover, production costs and operating loss for the financial year ended 31 December 2022 continued into Q1 2023.

“As a result January and February production volumes were lower and scrap costs were higher than planned.

“Cautious March loading rates have resulted in Q1 2023 sales being £1.4m, and the quarter loss making.

“Although the furnaces were trouble free in March, the company initially adopted a low risk strategy on individual furnace loading.

“Therefore the overall total output for the month of March did not fully reflect the underlying dramatic improvement in yield and furnace availability achieved across the month.”

On outlook for 2023, the company said: “The technical issues are now resolved, and demand remains strong. We are now ahead of the run rates required in Q1 and the board remains confident that the company will be profitable in Q2 2023 and thereafter.

“However, given the issues experienced in Q1 2023, and the ongoing production ramp in Q2, our overall profitability during FY 2023 is expected to be below market expectations.

“While the company and its supply chain will have the capacity to over produce against the original planned H2 2023 production, our OEM customers and their supply chains have their own constraints.

“Accordingly, it is premature to assume that these delayed sales will all be caught up in the year. Customer discussions are continuing, and we will update the market as appropriate in due course.

“Accordingly the board is planning its cash needs on the prudent assumption that delayed Q1 sales are not recovered in the short term.

“Despite this, the company will have sufficient cash to continue its extensive three year capital expenditure programme and working capital required as sales increase through the year.”

Surface Transforms CEO Kevin Johnson said: “We regard the progress made on resolving all the production technical issues to have been a major strategic breakthrough for Surface Transforms.

“In combination with the progressive implementation of the capacity increase, we are now confident of the timing of ongoing profitability.

“In our cash flow forecasting we have assumed that the shortfall in the first half of 2023 cannot be recovered in the second half.

“But even with this, hopefully prudent, assumption we are still expecting to have the cash to maintain the momentum of our three year capacity installation programme, and to fund our 2023 working capital need.

“During the strains of recent months, we are particularly pleased that our customers have understood the issues we have been facing, noted the progress and have continued constructive discussions on future programmes.

“The expectation of both parties, throughout this period, has been that we would fix the problems, which we have now done and install the capacity, which we are doing.

“Our order book (£290m) and prospective contract pipeline (£300m) are unchanged.”