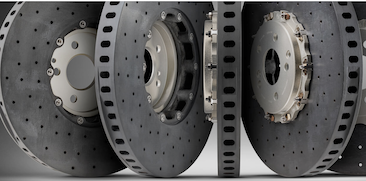

Shares of Liverpool-based Surface Transforms, makers of carbon fibre reinforced ceramic automotive brake discs, fell another 18% to a mere 3p after it responded to a shareholder request for its “worst case scenarios” by publishing a more detailed sales guidance for 2024.

Surface Transforms’ customers have included Aston Martin and Lamborghini.

On April 9, shares of Surface Transforms fell about 35% after the firm updated investors on its “capacity constraints” and “continuing high levels of scrap.”

The company’s shares are down about 90% for the past 12 months, reducing its stock market value to around £11 million.

“Sales are anticipated to grow by a minimum of 111% in 2024 and up to 165% compared to FY 2023 sales of £8.3m, resulting in a projected FY 2024 range of £17.5m to £22m sales,” said the company in a stock exchange statement on Wednesday.

“With the majority of the year still to come, 2024 sales outlook is dependent on the amount of progress made on reducing scrap, building capacity and delivering to customers.

“Sales were constrained in Q1 due primarily to scrap and constrained manufacturing capacity.

“Significant progress has been made on reducing scrap and this is expected to continue through 2024. Similarly progress on expanding our capacity during 2024 is advancing.

“As capacity increases from these operational activities it also creates the opportunity to deliver a more favourable product mix with customers.

“These three activities are all boosting sales and are driving our rapid growth during the year.

“We have detailed plans in place to continue to drive all three areas with the pace of progress determining a current spread in 2024 sales of approximately 20%.

“As we advance operational activities and deliver to customers we expect the sales range to narrow, and we therefore will provide updates on progress throughout the year.”

Surface Transforms CEO Kevin Johnson said: “We are providing this range of outcomes for the year, in response to shareholder request for ‘worst case scenarios’.

“We remain committed to achieving the higher end of this range.”