Shares of Manchester e-commerce, beauty and nutrition giant THG plc soared as much as 20% in late Friday afternoon trading following speculation in a deals blog report that private equity firms Advent International, Leonard Green Partners and Apollo are circling the company.

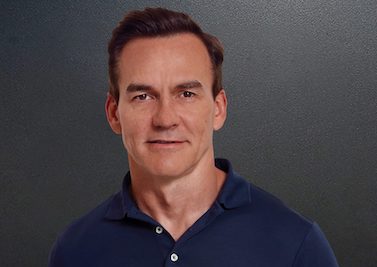

According to a report in Betaville, Advent is working with advisers Goldman Sachs on its interest in THG alongside the company’s founder and CEO Matt Moulding.

The report claimed that dealmakers from Apollo visited THG’s offices and one of the company’s warehouses this week.

Advisers from Jefferies are said to be working for THG on fielding the interest from the buyout firms.

There has been speculation about a takeover of THG since November when founder Moulding hinted in an interview with GQ Magazine that he might take the firm private again following its difficult first year as a public company.

In the interview, Moulding said he should have listed the company in the United States and not in London, and that the experience “has just sucked from start to finish.”

THG went public at £5 a share in September 2020 and the stock rose to around £8.

However, it fell to around £1.14 following a disastrous presentation to investors last October and concerns over its transparency and governance.

On Friday night, THG shares closed up about 16% at £1.32.