Shares of Manchester-based novel nanomaterials firm Nanoco Group plc fell more than 25% on Monday after the firm published a further update on its proposed litigation settlement with Samsung.

Nanoco said the gross settlement value “should be expected to be towards the lower end of the range of expectations for a successful jury trial outcome as previously guided by the company.”

On January 6, Nanoco shares rose about 40% after it announced that “a term sheet for a no fault settlement of the current litigation has been agreed between Nanoco and Samsung.”

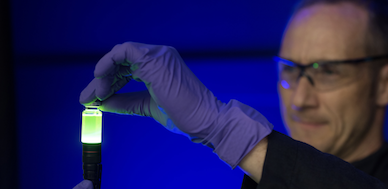

Nanoco had claimed that Samsung infringed on its unique synthesis and resin capabilities for quantum dots, Alliance News reported.

Quantum dot technology is used on Samsung QLED televisions. QLED stands for quantum light-emitting diode.

On Monday, Nanoco said: “The settlement process requires further negotiations and continues to operate within the control of the US judicial system, and hence the outcome of the litigation, its settlement, and timing are not wholly within the control of the parties.

“As a result of these factors, the value and terms of any final agreement are not yet certain.

“Details of the terms sheet and of any final agreement with Samsung are covered by a confidentiality agreement to protect the commercial interests of both parties during the ongoing negotiations.

“In evaluating the settlement offer and concluding that it provides a fair outcome for the company and its shareholders, the board, having consulted with its advisers in the litigation, took into account the following considerations …

“The gross settlement value should be expected to be towards the lower end of the range of expectations for a successful jury trial outcome as previously guided by the company …

“A settlement removes the risks of the litigation process, potential appeal processes of the trial and the ongoing appeal of the Patent Trial and Appeal Board decisions, further litigation costs, and the time value of money …

“Historical precedent shows that any final agreement is likely to be a one off payment, with no forward royalties, for the full and final settlement of all current and future patent litigation between the Parties in all jurisdictions (colloquially referred to as ‘patent peace’) …

“The company expects to issue a further update on the final agreement following the completion of the further negotiations between the parties.”

Nanoco chairman Christopher Richards said: “The board, having taken extensive advice from its advisers in the case, has concluded that the draft settlement offer provides a reasonable and immediate fair value for the litigation.

“The draft settlement accounts for both the potential downside risks of a jury trial, followed by what would likely be very protracted appeal processes, as well as the considerable adverse impact of further litigation costs and funding, and on the time value of money in a rising interest rate environment.

“Whilst there is still a degree of uncertainty around the final settlement agreement, we are working with Samsung to finalise the detailed agreement within the allowed 30 day period and look forward to updating shareholders further in due course.”

Nanoco CEO Brian Tenner said: “A settlement provides certainty to all our stakeholders and further reinforces our confidence in the validity and enforceability of the group’s global patent portfolio.

“I am more confident than ever about Nanoco’s future prospects.

“A settlement provides a firm financial underpinning to focus on our organic business, which has made significant progress over the last three years.

“It also demonstrates the company’s willingness to vigorously defend our global IP portfolio against any potentially infringing parties in the wider market.”